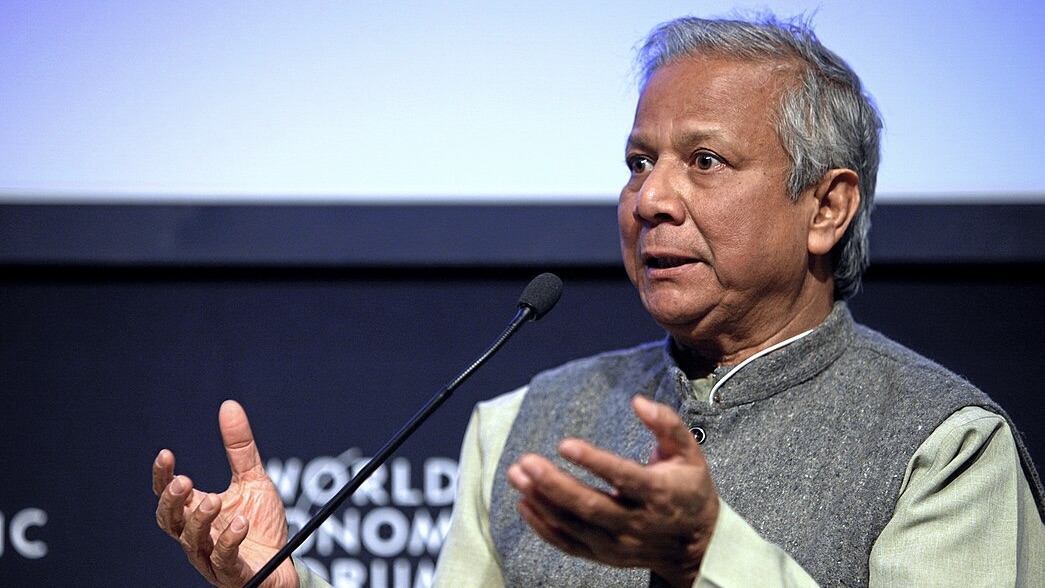

Muhammad Yunus story

Muhammad Yunus story

Muhammad Yunus story When it comes to social entrepreneurship and creativity in the battle against poverty,

In Bangladesh, a nation struggling with severe poverty and pervasive injustice,

his journey started in the 1970s. Yunus, an economics professor,

was profoundly impacted by the difficult conditions that the rural poor in his native country faced,

particularly the women. He thought that a lack of access to credit, which could enable individuals to better their own lives,

was the real cause of poverty rather than a lack of resources.

Yunus’s career took a significant turn when he started experimenting with microloans.

Working with rural crafters in Bangladesh in 1976,

he gave a group of women a small loan of $27 to purchase supplies to create and market bamboo stools.

Yunus saw that tiny loans may end the cycle of poverty if the ladies paid back the loan.

This prompted the establishment of the Grameen Bank in 1983,

a financial institution created exclusively to offer microcredit to the underprivileged, particularly women.

Because the bank’s approach did not require formal credit records or collateral,

two requirements that historically kept the poor out of the financial system, it was revolutionary.

The Grameen Bank concentrated on providing microloans, or small sums of money, to the underprivileged,

with a particular focus on empowering women.

Yunus recognized that women were frequently the foundation of their families and that

The model worked well.

Grameen Bank loans had remarkably high repayment rates, and the microloan concept started to take off around the world.

Yunus received international acclaim for his creative methods of combating poverty,

which led to his 2006 Nobel Peace Prize acceptance.

for their efforts to foster social and economic advancement from below. Numerous microfinance organizations worldwide have

his lending approach to combat poverty and empower women.

Yunus’s path hasn’t been without criticism, though. Despite their good intentions, some opponents contend that microloans can occasionally result in excessive debt, especially when borrowers find it difficult to repay their loans. In addition, Yunus has been involved in legal disputes in Bangladesh in recent years because of his employment with Grameen Bank, where he was accused of mismanaging the bank. Despite these obstacles, Yunus’s reputation as a leading advocate for social justice and economic growth endures.

The tale of Muhammad Yunus is proof of the strength of creativity and the notion that, with careful application, financial instruments may be a catalyst for social transformation. The way the world views poverty and development has changed as a result of his confidence in the potential of the impoverished, especially in the strength of women. Yunus’s influence is felt all over the world, whether it is through his groundbreaking work in microfinance or his more general support of social business models. His life’s work continues to motivate initiatives to combat injustice and advance sustainable development.

Share this content:

One thought on “Muhammad Yunus story”

Comments are closed.